Here in Charlottesville, we’re where you can find this new School regarding Virginia Health, one of several biggest teaching healthcare facilities regarding condition as well as on the latest Eastern Coast. Each year in america,16,000 the fresh new de amount scholar regarding abode.

Annually here in March, know as Fits Time, we see a special collect off people racing off to purchase house when they discover keyword that they can stay at UVA. Exactly as of numerous also are trying to offer these types of homes after the residencies are carried out.

These owners don’t have a lot of currency, haven’t had the time and energy to be much more financially literate, has actually hundreds of millions out-of upcoming money potential, and you can, on top of that, the majority of all of them will quickly purchase a mortgage.

Yet, from the basic criteria, obtained difficulty protecting a home loan. They do not have anything to set-out, he’s a lot of loans already, and possess zero confirmed income. They usually have not actually been their job but really once they purchase property in the a unique town.

Multiple lenders have created a program that enables these higher upcoming-earners to buy a home loan given that possibility of all of them defaulting are particularly reasonable (0.2%-lower than simply an elementary borrower) and they will soon you desire someplace accomplish the banking and purchasing, also.

Posting (): We have a minumum of one local financial offering loans at the 100% around $1

Even if these finance may have a somewhat large interest and you will fees, very customers usually takes away these types of financing as they do not have many other alternatives anyhow.

Generally restricted to a unique resident, the brand new probably (7-10 years away from home or shorter), or dental expert only (even though some bring financing to help you veterinarians, optometrists, podiatrists, and even attorney and several loan providers commonly provide to help you a doctor at any stage from their career, and the next domestic), it will require absolutely nothing money off (0-5%) and doesn’t require the fresh borrower to get mortgage insurance (PMI)

Extremely lenders need an agreement as proof coming income (unlike spend stubs your doctor will not yet , provides), but can have to have the physician to open a checking account at the lending company of which the mortgage is reduced of the car-write.

Certain programs allow people to make use of current currency to have an all the way down fee, to own needed supplies, or closing costs, nonetheless it demands cash reserves equivalent to two months away from idea, attention, https://simplycashadvance.net/title-loans-co/ fees, and you will insurance policies (PITI), a relatively good credit rating, and you may that loan percentage so you can income proportion out-of less than 38% (of up to fifty% with some lenders)

You will find some sort of homes that such as a citizen try from time to time restricted regarding, such as for instance apartments, but in standard such financing are used for one household

It financing usually will not determine figuratively speaking towards the mortgage to earnings proportion otherwise uses a modified repayments just as the Earnings Depending Installment/Spend Because you Earn computation.

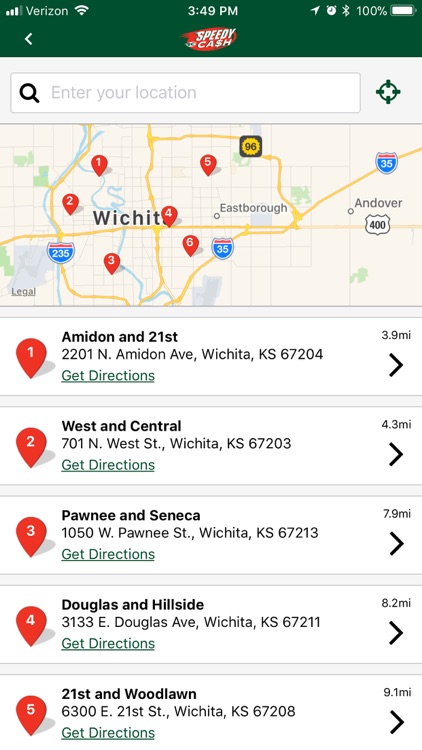

There are certain finance companies and you can representatives who will assist your which have an excellent healthcare provider’s loan. Every one of these just also provides funds in some states, generally there may only be several ones selection available to you. The selection procedure is created much easier of the undeniable fact that not totally all loan providers should be for sale in your state.

NOTE: Inquiring the Choice Representative to possess a suggestion makes a good amount of sense even as we work on many each other local and you will federal loan providers.

The doctor’s mortgage rates generally has the highest one to, nevertheless the down payment ‘s the littlest (certain applications only zero down). The new costs try where something rating most fuzzy and difficult to contrast.