If we need to purchase another house otherwise redesign your own present domestic, acquire to pay your finances or to consolidate your debt, BCU Financial has got the proper borrowing choices for your specific demands having attractive cost to the our credit union mortgage and you will installment preparations that have your financial otherwise mortgage paid at some point.

An unsecured loan is a one-date lump sum loan to possess if you want to obtain good certain quantity of money while making a large pick including to find a vehicle, paying for a wedding, or bringing anywhere near this much-deserved travel. The interest rate you choose will determine your loan amortization period along with your mortgage re also-percentage schedule.

Financing & Lines of credit

Fixed Interest rate is actually mortgage loan you to definitely stays a similar for the duration of the loan visit the site right here. It’s the best choice if you want to adhere to a funds and so are seeking set monthly obligations. A fixed rates financing keeps a structured payment agenda and that means you will know how much you should repay per month assuming you loan is paid-in complete.

Variable Interest are mortgage one increases otherwise down, once the BCU Financial Perfect Rates change. Its the right choice if you’re not concerned about switching interest prices and want to work with when rates of interest drop-off. If interest rates go-down, a lot more of the typical commission goes with the repaying your own dominant, in order to pay off your loan reduced. If the rates rise, a lot more of their normal fee happens towards the paying down the eye, which means that your monthly installments increases.

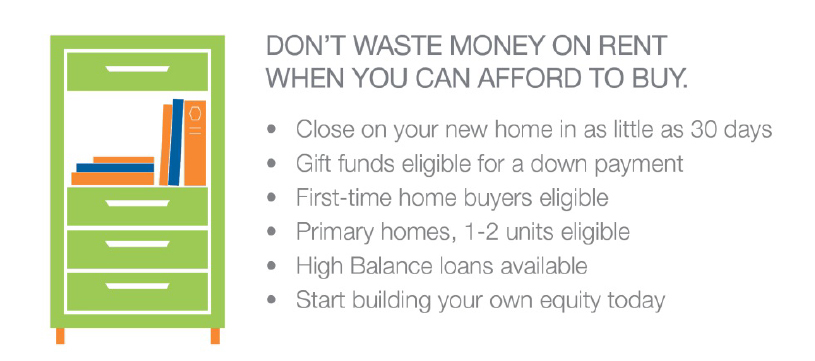

The first Mortgage

BCU Financial loan calculating and you can home loan apps is rather easy, but you can help make your approval techniques for a financial loan otherwise a line of credit beginning much easier from the upcoming wishing along with the mandatory advice. We must determine you as a borrower and ensure your produces your payments timely. We shall look at the possessions, expense, money and you will credit history.

Identification: Attempt to render images character along with you, such as for instance a beneficial driver’s license. you will have to bring your own public insurance amount.

Credit score: Just be sure to have your credit score and credit rating offered. You could acquisition a copy of the credit score out of Equifax Canada otherwise TransUnion. Which declaration include details about all the loan you take in the last half a dozen age – whether or not you regularly pay on time, just how much you borrowed from, exactly what your borrowing limit is found on each membership and you can an inventory off subscribed borrowing grantors who have reached your file.

Proof Money: Attempt to bring shell out stubs from your place of a position and you will a duplicate of your own prior income tax come back. You will additionally have to bring your boss contact information.

Possessions and you can Bills: You ought to provide people capital property you may have. It’s also advisable to render a listing of debts, such as for example mastercard balance, student education loans plus leasing history.

You want a different vehicles, but don’t a bit have the funds saved up to get that? BCU Economic will help you see a credit service that is true for your requirements. Just like the a good BCU Monetary affiliate, you will see entry to our highly competitive interest rates that have the selection of a fixed otherwise varying-rate loan. A great BCU Financial Car finance provides you with a customized fees schedule, and that means you find the time of your loan and an adaptable commission accessibility to weekly, bi-month-to-month or monthly obligations. Find out more about our very own current special prices towards car loans Right here.

If you wish to make a massive contribution toward RRSP before annual taxation filing due date but never have enough financing in your account to do it, after that taking out an enthusiastic RRSP loan will allow you to reach your mission. RSP loans provides you with the required loans to catch abreast of the latest benefits we need to make so you could and take advantage of the higher taxation discounts given by this new Canadian regulators.

Do you have multiple credit card bills, and other debt eg a student loan otherwise a motor vehicle loan? BCU Financial helps you with a debt negotiation loan calculating organize the of several costs for the one to smoother monthly payment that’ll maybe you have investing smaller in desire than their other mortgage costs mutual. BCU Monetary are working with you to discover the best you’ll be able to interest rate provided by a solution to choose a weekly, bi-monthly or monthly fees schedule.

That loan for your constant credit means. You are accepted to have a pre-set maximum, and you borrow only the number you need, when you need it. A line of credit beginning could help with since the cost away from do-it-yourself strategies otherwise assist you with family unit members expenses such as for instance once the scientific and dental care debts, good newborns knowledge, or an older members of the family member’s proper care. You pay appeal on the amount your borrow, and pay-off people matter so long as you improve minimal payment. Minimal costs could be a combination of desire and you will dominant or attract just. After you pay your debts you could potentially recycle the new offered borrowing as opposed to lso are-applying.

Policy for the fresh new unanticipated that have BCU Economic Overdraft Coverage. You no longer require to be concerned after you generate a otherwise swipe your debit card that you have enough profit your own family savings to completely fund the transaction. If you have BCU Economic Overdraft Shelter you will provides comfort just like the a great pre-recognized sum of money could be open to your bank account, which means that your cheque and you will debit transaction will obvious anytime.

If you have no less than thirty-five% security in your home, you could potentially be eligible for a home Equity Line of credit. Domestic security ‘s the difference in the value of your house as well as the outstanding balance of the residence’s financial. These are very flexible loans used to possess any sort of you prefer: funds to possess do it yourself, degree expenditures, financing options or debt consolidation reduction. Their residence’s security grows every time you reduce your mortgage which means the worth of your home grows. That with your residence as the equity, you may also be eligible for a diminished interest and more substantial credit limit.

If you need some assistance purchasing the fresh new rising price of getting a blog post-additional education, following BCU Financial can help. The fresh new BCU Monetary Pupil Personal line of credit lets good college or university otherwise scholar in order to use around a maximum of $5,000 a-year to purchase price of university fees, guides otherwise cost of living. In place of an unsecured loan, that have that loan getting a student one pays precisely the interest towards the count they withdraw. To meet the requirements, you need to be signed up for an entire-time system at an accredited university which have Canadian citizenship or got immigrant reputation.