In Canada, securing a home loan can be a significant milestone on travel in order to homeownership. Whether you’re a first-big date client otherwise seeking to re-finance your current domestic, knowing the schedule having financial acceptance is extremely important.

Given that procedure can vary according to numerous products, there are general guidelines to help you welcome how long they usually takes to-be recognized to own home financing from inside the Canada.

Initial Actions: Get yourself ready for the loan Application

Just before diving on the timeline, you have to prepare the necessary documentation and evaluate your financial situation. Lenders usually opinion debt history, credit rating, money stability, and you will financial obligation-to-earnings proportion when considering your own home loan software. Event data such as for example pay stubs, taxation statements, financial statements, and you can evidence of assets commonly improve the process.

When we features our basic discussion, possibly on the cell phone or in individual, I could consult with your such documents conditions and you will allow you to know those that I would like.

The brand new timeline having financial recognition is generally speaking happens anywhere between eight and 2 weeks. Here is an overview of the main degree of mortgage acceptance. And don’t forget that each home loan disease differs, and therefore most of the schedule will change too:

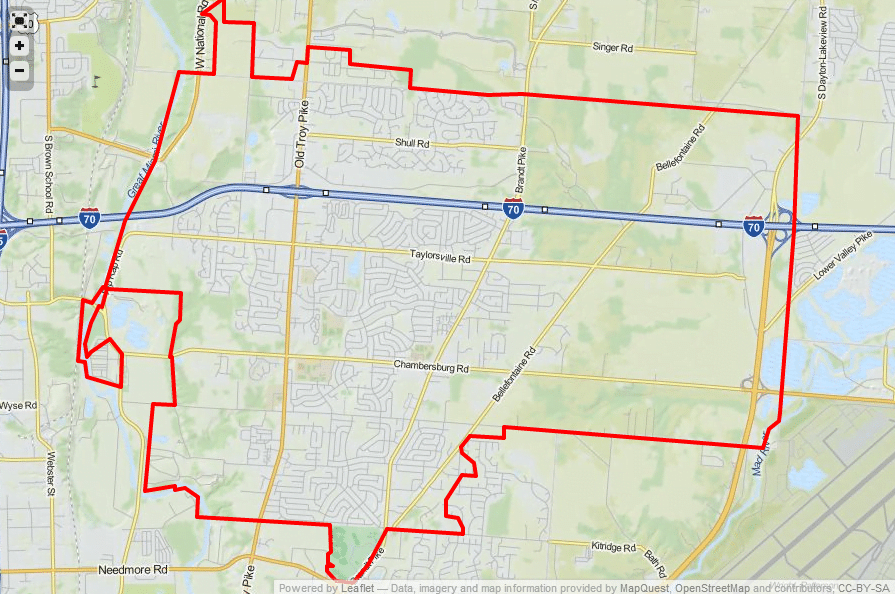

- Pre-Approval: I Rye loans always suggest taking pre-approved in advance of domestic bing search. This task comes to entry your financial guidance to me, then i evaluate the qualification having a mortgage and supply good conditional pre-approval for a specified matter. Pre-recognition will be based upon particular lender direction and i will provide you that have a quote for a cost and you will rate.

- Family Hunting (Variable): Shortly after pre-acknowledged, you could begin looking for a home within your budget. Along so it phase of course may differ according to field standards, your preferences, and you will supply.

- Official Financial Application: After you have located property, we’ll must submit a proper mortgage app towards picked lender. This calls for delivering detail by detail economic suggestions and files. The lending company will then conduct a thorough analysis.

- Mortgage Underwriting: After researching the application, the new lender’s underwriting cluster analysis your financial data, appraises the house or property if the you’ll end up getting an advance payment off 20% or more, and you may verifies everything considering.

- Conditional Acceptance: When the everything reads, you are getting conditional acceptance, at the mercy of meeting particular standards. Such requirements start from providing additional records, protecting home loan insurance coverage (in the event the applicable), otherwise addressing people a fantastic circumstances.

- Finally Recognition and you can Mortgage Promote: Once you have came across all the criteria, the lending company has latest recognition and makes the borrowed funds bring. Which document traces the fresh conditions and terms of one’s loan, such as the interest, payment plan and one applicable fees.

- Closing: Toward financial offer in hand, you might move on to closing, where judge and you may monetary conformity is completed, and possession of the house are directed. The fresh new closure schedule may differ but usually happen in this 31 to ninety days of one’s bring acceptance, enabling time for employment for example all about home inspections, appraisals, and you may judge actions.

Products Impacting Recognition Timelines

Speaking of all quotes regarding how long all these tips may take. Multiple circumstances is also dictate the length of time it will take is acknowledged and it’s vital that you know very well what people is actually:

- Complexity of Software: Applications that have multiple individuals, self-a job earnings, or non-traditional sourced elements of money takes longer to processes.

- Lender’s Work: High demand otherwise active attacks could lead to offered running times. Certain loan providers will require longer than anybody else also.

Start today.

While the timeline to possess mortgage acceptance from inside the Canada can vary, understanding the secret amounts and you will situations with it might help perform expectations and improve the procedure.

From the planning carefully, working with a large financial company, selecting the most appropriate lender for you, and you may being hands-on on process, you can browse the trail to help you homeownership with certainty!

Whether you’re a primary-go out buyer otherwise a skilled citizen, the faster you reach off to a large financial company, the easier the home to order processes might be! Call me at the 250-826-3111, apply back at my webpages or contact me through my personal on the internet get in touch with function to begin with the method now.