Compare fifteen & 20 12 months Repaired Speed Mortgages

Just what Financing Would Home buyers Like?

Along the United states 88% away from home buyers finance its instructions that have a home loan. Of them people who funds a buy, nearly 90% ones opt for a thirty-seasons repaired speed loan. The fresh fifteen-seasons fixed-speed mortgage ‘s the next top home loan choices certainly People in the us, with six% away from consumers going for a fifteen-12 months mortgage name.

Whenever rates of interest is reasonable (while they was basically after the worldwide market meltdown try followed closely by of many series off quantitative easing) home buyers has actually an effective taste to possess fixed-rate mortgages. Whenever interest rates increase people commonly move a lot more toward using adjustable-price mortgage loans to buy homes.

Really consumers getting mortgages to acquire a house pick the 30-seasons repaired-speed financial. It completely dominates the acquisition sector.

If an individual appears entirely in the commands FRMs are about ninety% of sector. 30-12 months finance also are a famous choice for refinancing residents, even though the 15-season option is plus appealing to individuals refinancing the fund. The second graph suggests the brand new combined full markets standing, but if you is also compare it contrary to the significantly more than chart you can be picture how 15-year finance are a lot more popular getting refinancing compared to very first family commands.

Benefits of a thirty-Year Home loan

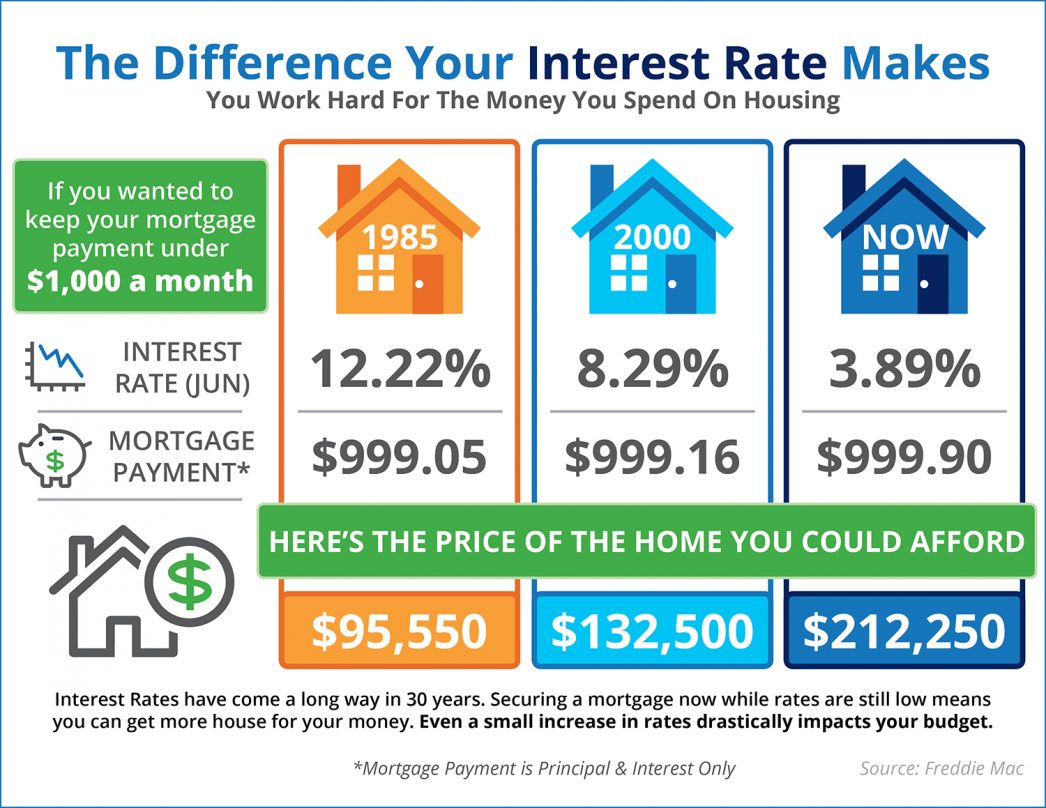

The big advantage of a 30-12 months online installment loans Delaware financial more a great 15-12 months mortgage was a lesser payment per month. (more…)